In this journal entry, the raw materials inventory account is an account that represents the raw materials we have on the balance sheet. And, this account usually includes both the direct raw materials and the indirect raw materials. In contrast, when overhead is overapplied, manufacturing overhead costs have been overstated and therefore inventories and/or expenses need to be adjusted downward. There are two ways to adjust for the under- or overapplied overhead amounts. Finally, on completion the total costs of a job are transferred from its job cost sheet in the WIP ledger to the finished goods inventory account. On sale the costs are then transferred from the finished goods inventory account to the cost of sales account in the usual manner.

- On completion the business knowing the total cost and selling price can then determine the profitability of the job.

- Wheneverwe use an estimate instead of actual numbers, it should be expectedthat an adjustment is needed.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- The predetermined manufacturing overhead rate is discussed in detail in subsequent sections of this chapter.

- Job order costing is an accounting system that traces the individual costs directly to a final job or service, instead of to the production department.

Job Costing Example Problem

In job order costing, each job is typically worked on at its unique location on the production floor as material and labor come to the products, which remain in place. The Raw Materials inventory account is used to record the costs for all raw materials—direct and indirect—purchased to manufacture a product. The stocksfortots formula for computing the departmental predetermined manufacturing overhead rates is presented in Exhibit 2-7. Exhibit 2-3 Formula for organization-wide predetermined manufacturing overhead rate. The formula for computing an organization-wide predetermined manufacturing overhead rate is presented in Exhibit 2-3.

Predetermined overhead rate

These property taxes are considered indirect manufacturing costs and should be applied to all jobs produced during the year and not just the jobs in process at the time the taxes are paid. Similar to indirect materials, indirect labor cannot be directly assigned to specific jobs but they are related to the production operation as a whole. Hence, these indirect labor costs will also need to be recorded in the cost pool of manufacturing overhead before they are further transferred to the work in process account. In some cases, organizations choose not to use a single, organization-wide predetermined manufacturing overhead rate to apply manufacturing overhead to the products or services produced.

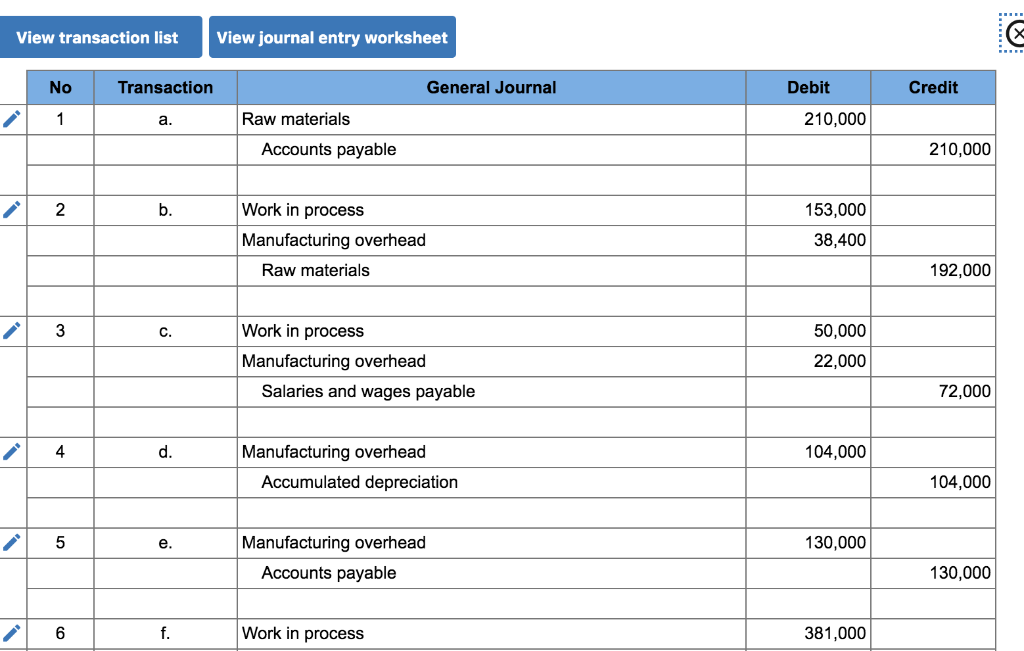

7 Prepare Journal Entries for a Job Order Cost System

Job-order costing is an accounting system used to assign costs to the products or services that an organization produces. $2.8 million worth of raw materials were used in the project as direct materials. Since the manufacture of the airplane is a one-off project, job-order costing is the most appropriate cost accumulation system. Rookwood Pottery makes a variety of pottery products that it sells to retailers. As an example, law firms or accounting firms use job order costing because every client is different and unique.

Job costing accounting involves transferring costs from the raw materials, labor and manufacturing overhead accounts to a work in process (WIP) account. Each job has its own work in process account usually referred to as a job cost sheet to accumulate its respective costs. In this stage of job order costing, we usually use the predetermined overhead rate that is based on the estimated annual overhead and estimated annual activities such as estimated annual direct labor cost or direct labor hours. In job order costing, the cost of direct materials that move from the storeroom to the production will need to be recorded to the work in process before it transforms into the finished goods. And it is the same for the direct labor costs involved in the production process.

Job Costing Accounting System

The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $\$ 4,800,000$ in manufacturing overhead cost at an activity level of 240,000 machine-hours. Underapplied and Overapplied Overhead LO3-4Osborn Manufacturing uses a predetermined overhead rate of $\$ 18.20$ per direct labor-hour. This predetermined rate was based on a cost formula that estimates $\$ 218,400$ of total manufacturing overhead for an estimated activity level of 12,000 direct labor-hours. Prior to the sale of the product, separating production costs and assigning them to the product results in these costs remaining with the inventory. Until they are sold, the costs incurred are reflected in an assortment of inventory accounts, such as raw materials inventory, work in process inventory, and finished goods inventory.

This entry records the completion of Job 106 by moving the total cost FROM work in process inventory TO finished goods inventory. Examples include home builders who design specific houses for each customer and accumulate the costs separately for each job, and caterers who accumulate the costs of each banquet separately. Consulting, law, and public accounting firms use job costing to measure the costs of serving each client. Motion pictures, printing, and other industries where unique jobs are produced use job costing. Hospitals also use job costing to determine the cost of each patient’s care. Assume that Roberts Wonder Wood is a factory that produces custom kitchen cabinets.

The inventory asset accounts and expense accounts used in a job-order costing system are discussed in detail in this section. The accounting terms of debit and credit are used to identify the increases and decreases made to each account during the process. A summary of the accounting equation and the accounting rules of debit and credit are provided in Exhibit 2-1 below. Additionally, the flow of costs in a job-order costing system is demonstrated in Video Illustration 2-1. The total job cost of Job 106 is $27,950 for the total work done on the job, including costs in beginning Work in Process Inventory on July 1 and costs added during July.

For example, an organization that produces a labor intensive product might select direct labor hours as the allocation base. Whereas, an organization that relies on machines instead of laborers might use machine hours as the allocation base. The direct materials, direct labor, and applied overhead are now posted to the job cost sheets in the WIP ledger as debit entries.