Think of manufacturing overhead as a pool or bucket of all indirect product costs. At the beginning of the period, the total amount of manufacturing overhead costs are estimated based on historical data and current year production estimates. Throughout the year, the total amount of estimated manufacturing overhead is uniformly applied to the jobs in process using some type of allocation base or cost driver. An allocation base or cost driver is a production activity that drives costs. Common allocation bases are direct labor hours, machine hours, direct labor dollars, or direct materials dollars. At the end of the year, the estimated applied overhead costs and actual overhead costs incurred are reconciled and any difference is adjusted.

Video Illustration 2-2: Computing an organization-wide predetermined manufacturing overhead rate LO3

Indirect materials are raw materials that cannot be easily and economically traced to the production of the product, e.g. glue, nails, sandpaper, towels, etc. When overhead is underapplied, manufacturing overhead costs have been understated and upward adjustments need to be made to inventory and/or expense accounts, depending on which method the company decides to use. The table below shows the actual factory overhead costs and the direct labor hours for May and June.

- Even if several jobs are started at once, it does not necessarily mean that they will all be completed at the same time.

- Job 16 had 875 machine-hours so we would charge overhead of $1,750 (850 machine-hours x $2 per machine-hour).

- We will discuss the difference between actual and applied overhead and how we handle the differences in the next sections.

- Her contractor will design the deck, price the necessary components (in this case, the direct materials, direct labor, and overhead), and construct it.

- The company allocates overhead costs to jobs at a rate of 35% of total direct labor cost incurred.

Overhead rate example

The company computes a separate factory overhead rate at the end of each month. The diagram also shows the departments that report to the production unit director and gives an indication as to the flow of goods through production. The flow of goods through production is more evident in Figure 8.2, which depicts Dinosaur Vinyl as a simple factory with three stages of production. DS purchased raw materials (such as aluminum, fiber, etc.) at a cost of $4 million. The production department employees work on the sign and send it over to the finishing/assembly department when they have completed their portion of the job. The total cost of this job is $10,100, as is shown in the final debit balance in Work in Process ledger.

Which of these is most important for your financial advisor to have?

An expense is a cost of operations that a company incurs to generate revenue. Generally, the benefit of the cost is used in the same period in which the corresponding revenue is reported. The following information relates to production costs and usage for Roberts during August. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

In short, the predetermined manufacturing overhead rate can be a certain percentage of labor cost or a certain dollar per labor hour, etc. The basic concept is to make sure that we have an appropriate application of the overhead cost to specific jobs. Creative Compton, Inc. is an advertising agency that nonprofit statement of activities explained mip fund accounting designs web sites and promotional materials for medium-sized businesses. For each client project, Creative Compton accumulates the direct labor costs of its professional designersat an hourly rate of $140. The company allocates overhead costs to jobs at a rate of 35% of total direct labor cost incurred.

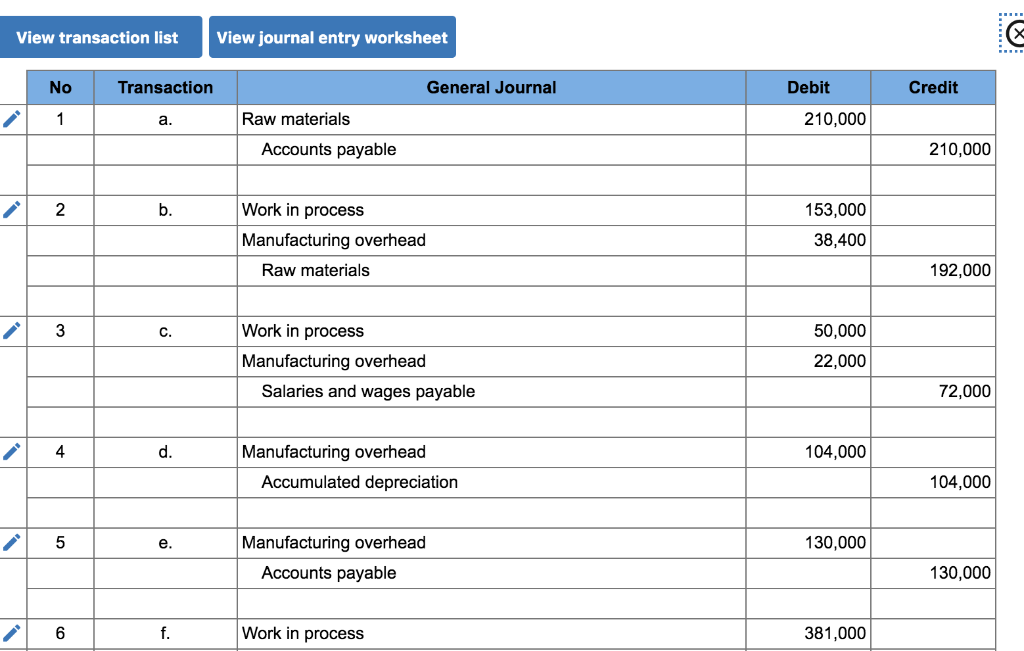

Before multiple predetermined manufacturing overhead rates can be computed, manufacturing overhead costs must be assigned to departments or processes. The WIP inventory asset account is where the actual direct materials cost, actual direct labor cost, and estimated manufacturing overhead costs are recorded in order to determine the COGM. All manufacturing costs incurred to complete a job are recorded on job cost sheets. A standard job cost sheet records all direct material, direct labor, and manufacturing overhead costs applied to a job. Typically, a job cost sheet also records the total costs, the number of units, the cost per unit, as well as the selling price for each job. The job cost sheet for Job A shows a beginning balance of accumulated costs brought down of 100.

To this are added direct materials 160, direct labor 180, and manufacturing overheads of 135. When the job is completed the total costs amount to 575 and these are transferred from the job cost sheet to the finished goods inventory account leaving a balance of zero on the WIP ledger for Job A. For example, Coca-Cola may use process costing to track its costs to produce its beverages. In job order costing, the company tracks the direct materials, the direct labor, and the manufacturing overhead costs to determine the cost of goods manufactured (COGM). In job order costing, the manufacturing overhead is the cost that is related to the production operation as a whole but cannot be directly assigned to specific jobs. And manufacturing overhead includes the indirect materials, indirect labor, and other indirect expenses such as utility, rent, insurance, depreciation expense, etc.

On completion the business knowing the total cost and selling price can then determine the profitability of the job. Job costing accounting or job order costing is a costing method in which costs are accumulated and analysed by individual jobs or orders. The problem with job order costing is that it can get very costly because it assigns product costs using a more complex allocation system, usually requiring more detailed data for each job.